How to Prepare Financially for a Contested Divorce in Georgia

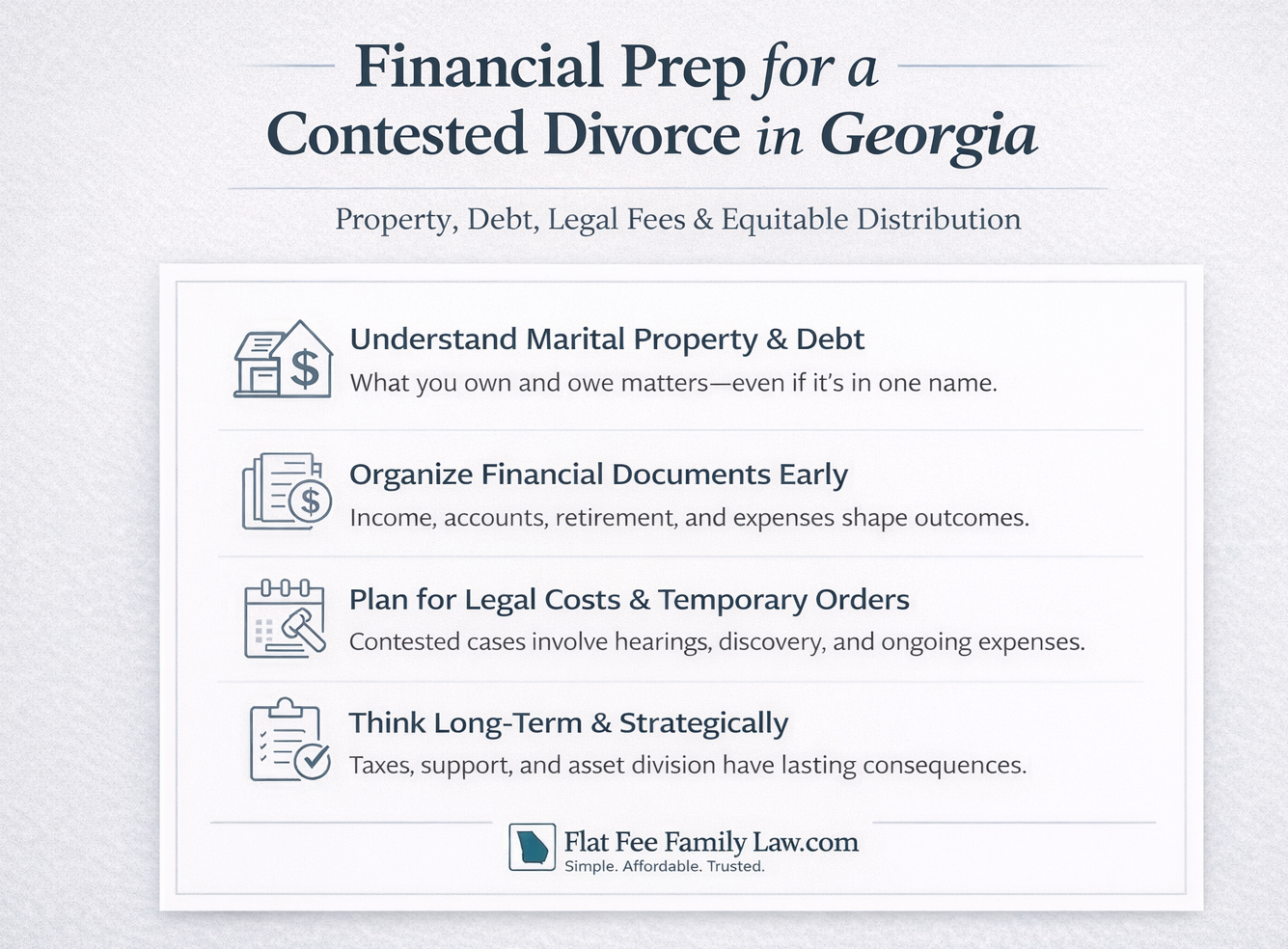

A contested divorce is as much a financial process as it is a legal one. In Georgia, disputes over property, income, custody, and support can quickly increase costs, extend timelines, and create long-term financial consequences if you are not prepared from the outset.

Whether you anticipate disagreements over assets, parenting time, or support, taking early financial steps can help you protect yourself, reduce stress, and make informed decisions as your case moves forward.

This guide explains how to prepare financially for a contested divorce in Georgia, what to gather before filing, and how to avoid common financial mistakes that can undermine your case.

What Makes a Divorce “Contested” in Georgia?

A divorce is considered contested when spouses cannot agree on one or more key issues, including:

- Division of marital property and debt

- Child custody or parenting time

- Child support

- Alimony

- Responsibility for legal fees

Even if only one issue is disputed, the case may require court involvement, formal discovery, hearings, and potentially a trial. Each step adds time, cost, and complexity—making financial preparation especially important.

Step 1: Understand Your Full Financial Picture

Before filing—or even meeting with an attorney—you should have a clear understanding of your financial situation.

Start by identifying:

Income

- Pay stubs (last 6–12 months)

- Bonuses, commissions, or overtime

- Self-employment or business income

- Rental or passive income

Assets

- Bank accounts (checking, savings, money market)

- Retirement accounts (401(k), pension, IRA)

- Investment accounts

- Real estate

- Vehicles

- Business interests

- Life insurance with cash value

Debts

- Mortgages and home equity loans

- Credit cards

- Auto loans

- Student loans

- Personal loans

- Business debt

How Georgia Treats Property and Debt

In Georgia, most property, and debt, acquired during the marriage is considered marital, even if only one spouse’s name is on the account or loan. Courts look at when an asset was acquired or debt was incurred—not just whose name is attached—when deciding how to divide financial responsibility. Knowing what exists, when it was acquired, and how it has been used matters.

Step 2: Gather and Preserve Financial Documents Early

Once divorce becomes likely, financial records can become harder to access. Gathering documents early helps prevent disputes and delays later.

Important documents include:

- Tax returns from the last 3–5 years

- Bank and credit card statements

- Retirement account statements

- Mortgage statements and deeds

- Vehicle titles and loan documents

- Business financial records

- Insurance policies

- Monthly household expenses and bills

Step 3: Build a Realistic Post-Separation Budget

One of the biggest financial challenges in a contested divorce is adjusting from one household to two. Create a monthly budget that includes:

- Housing

- Utilities

- Food and transportation

- Health insurance

- Child-related expenses

- Debt payments

- Legal fees

This budget is not only for planning—it can influence court decisions related to temporary support, alimony, and child support.

Step 4: Understand How Georgia Divides Marital Property

Georgia uses an equitable distribution system, not automatic 50/50 division.

Courts consider factors such as:

- Length of the marriage

- Each spouse’s contributions (financial and non-financial)

- Each spouse’s earning capacity

- Separate property claims

- Conduct that impacted marital finances

Financial documentation plays a critical role in how assets and debts are ultimately divided.

Step 5: Prepare for Temporary Financial Orders

In contested cases, judges often issue temporary orders that can remain in place for months or longer.

Temporary orders may address:

- Child support

- Alimony

- Use of the marital residence

- Responsibility for household expenses

- Parenting time

Because these orders shape financial reality while the case is pending, being prepared financially from the start matters.

Step 6: Plan for Legal Costs Strategically

Contested divorces are more expensive than uncontested cases, particularly when they involve:

- Formal discovery

- Multiple hearings

- Custody evaluations

- Expert witnesses

Understanding your attorney’s fee structure is essential. Most firms bill hourly with unpredictable costs. Flat Fee Family Law.com offers flat-fee pricing, giving clients clearer expectations and better budgeting control.

Step 7: Avoid Common Financial Mistakes

Certain actions can seriously harm both your finances and your legal position:

- Hiding assets or income

- Draining joint accounts

- Taking on unnecessary debt

- Ignoring court orders or informal agreements

Georgia courts expect transparency and reasonableness. Financial discipline during divorce is not just responsible—it’s strategic.

Step 8: Consider Long-Term and Tax Consequences

Divorce decisions affect more than immediate cash flow. Consider:

- Tax treatment of alimony

- Capital gains on property transfers

- Division of retirement accounts

- Filing status changes

- Dependency exemptions and child-related tax credits

Failing to plan for these issues can result in unexpected financial consequences years after the divorce is final.

Final Thoughts

If you anticipate a contested divorce, working with an attorney who provides clear expectations and transparent pricing can make a meaningful difference. Financial preparation is not just about protecting assets—it’s about positioning yourself for informed, strategic decisions throughout the process.

At Flat Fee Family Law.com, our attorney helps Georgia clients navigate contested divorce cases with clarity, predictable fees, and payment plan options.

Schedule a consultation today to learn how we can help you prepare financially and move forward with confidence.

Is debt divided the same way as property in Georgia?

Generally, yes. Debt incurred during the marriage is typically considered marital, even if only one spouse’s name appears on the loan.

Is everything split 50/50?

No. Georgia courts divide marital property and debt equitably, not automatically equally.

When should I start preparing financially?

Ideally before filing, or immediately after separation—especially if you expect disputes.

Can financial preparation shorten a contested divorce?

Yes. Organized financial records reduce delays, disputes, and unnecessary legal costs.